French newspaper La Tribune organizes every year a day of conferences on all topics relating to aerospace. This year, it took place the day before the larger Paris Air Show kicked off, after four years of absence, so the panels were fuller than usual with top-level executives. The track dedicated to space included a series of very interesting talks regarding European New Space, launchers, French military space and the subject of this article, the European IRIS² secure communications constellation.

Dramatis personæ

The panel gathered three types of people:

- First, the European Union, represented by Ekaterini Kavvada, director in charge of innovation and promotion at the general directorate for defense industry and space (DEFIS) of the EU commission. IRIS² (short for Infrastructure for Resilience, Interconnectivity and Security by Satellite) falls under her purview. At higher levels, it enjoys major support from internal market commissioner Thierry Breton.

- Second, the members of the only bidder left for the IRIS² contract, a consortium gathering all of the large European Space companies: one one hand satellite manufacturers Airbus Defence and Space, Thales Alenia Space (and its mother companies Telespazio and Thales) and OHB, and on the other hand satellite communication providers Eutelsat, Hispasat, SES and Hisdesat. For good measure, the communications providers Orange and Deutsche Telecom are also part of it. On the panel were Antonio Abad, the CTO of Hispasat, Ruy Pinto, CTO and interim CEO of SES, and Hervé Derrey, CEO of Thales Alenia Space.

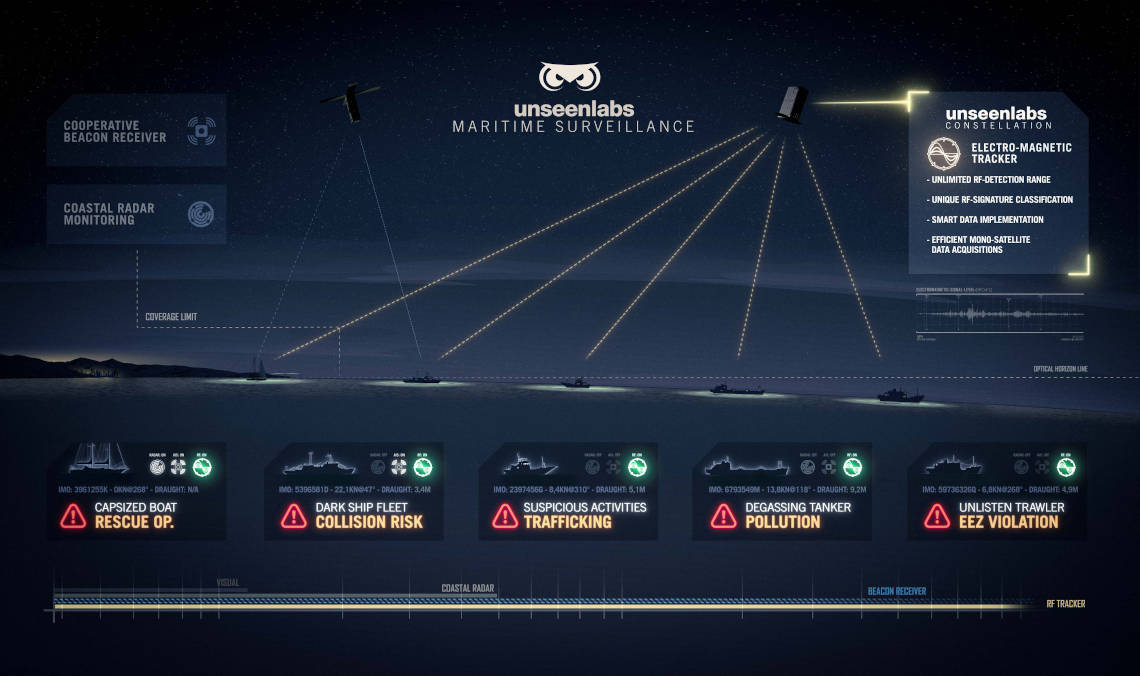

- A lone representative of the New Space companies and SMEs, in the person of Jonathan Galic, President of Unseenlabs, a French company operating a constellation of emitter-location satellites for maritime surveillance

To round it up, the panel was moderated by veteran space report Peter B de Selding, editor of SpaceIntelReport.

Company descriptions and initial IRIS² views

Mr de Selding started the conversation by asking the attendees to quickly describe their business.

Galic opened this round of questions, describing Unseenlabs. His company operates a constellation of 9 satellites, with more coming, the optimal size being around 25 to 30 but very much depending on demand. The current service they sell is maritime surveillance using radiofrequency signals, although in the future other services might be introduced. Unseenlabs has a secret sauce which enables them to use only one satellite for emitter location, whereas other companies require two or more for the same thing. So each of the 9 satellites provides detection of emitters (to be understood as navigation radars and radio communications including AIS) across a wide swath (>500km), with better than 1km accuracy. That gives the constellation as a whole a good revisit rate, with a low latency of information transfer. This further enables tipping & cueing imaging satellites when a vessel of interest is detected. One of the main use cases for the service is fighting organized crime at sea, for instance large illegal shipping fleets.

More to the topic of the session, Unseenlab carried out along with other small and medium entreprises (SMEs) an early phase system architecture study for IRIS².

Abad followed, talking about Hispasat. It is a Spanish satellite communications provider doing business in Europe, North Africa and South America. Historically, it was only an operator of GEO satellites, selling capacity to customers. However, it has started moving up the value chain, going from selling capacity to selling a service. That means the customer buys an internet service with a given volume for instance, and Hispasat then uses its own satellites, or buys capacity of third parties to deliver that volume. Similarly, it also sells the capacity of its satellites to other operators.

Abad stated that Hispasat has identified a niche for commercial applications of IRIS², namely businesses that want some specific security or latency requirements. For him, the Public-Private Partnership (PPP) at the core of IRIS² makes a lot of sense, as the purely commercial market is not large enough to make a constellation profitable by itself, but if services to governments pay for a share of the cost then the business case makes sense. He also underlined that commercial hosted payloads on IRIS² satellites are an area worth looking into.

Finally, he concluded that from a more industrial point of view, if the European manufacturers want to keep the lead on the market that they currently have in large software-defined GEO communications satellites, IRIS² is necessary so they can also be a leader in LEO communications satellites in the future, and that if Europe does not invest now, in fifteen years its big players will have disappeared.

Following that was fellow GEO operator Pinto, from SES. He shared his view of the market, painting it as disrupted. SES has already invested in new generation satellites (the O3b mPower MEO constellation), and while it used to see LEO as a bad idea, it has now warmed up to the idea of an integrated multi-orbit constellation, with elements in LEO, MEO and GEO networked together using inter satellite links. IRIS² aims to be that, and SES sees commercial business opportunities for it not only in Europe but on a global scale. He also remarked that given the track record of Copernicus and Galileo, IRIS² is here to stay, giving a long term perspective. Consequently, the time IRIS² needs to be set up and pay back its investment is not a big concern for him, since as a GEO operator he is accustomed to return over investments over fifteen years. He concluded that Europe needs to act quickly as China and the US are not waiting for us.

Now onto the manufacturer’s perspective. Thales Alenia Space ‘s CEO Derrey detailed his view of the communications market, by segmenting it in two parts:

- The broadband solutions, addressing airplane, cruise and other non-consumer markets. There, a multi-orbit constellation has advantages of one using a single type of orbit. He also sees a market for more than two constellations there, so for him there is a future beyond Starlink and Kuiper.

- The narrowband (ie relatively low-throughput) segment, addressing the Internet of Things and direct-to-device markets, like for instance the emergency call function on the new iPhone, which uses the Iridium constellation.

For him, space communications can grab part of the terrestrial communication market this time (it did not work out well in the 90s). On a more technical side, the inclusion of the 5G standard into IRIS² would make it much more competitive in the direct-to-device market, and cybersecurity requirements are a must have given recent events. Interestingly, Thales Alenia Space does not exclude putting some of its own money into IRIS², encouraged by the commercial success of the Iridium Next constellation it has built (and mistakenly not invested in).

The commission’s view

Now onto the piece of resistance, director Kavvada‘s views. She started by explaining the timeline for IRIS²:

- The 1st phase is to pick among the bidders the eligible consortium. She did not announce a winner but since apart from the big consortium mentioned above, the other 4 applicants have been rejected, the is not much suspense.

- The 2nd phase is a dialogue with the winning consortium. She expects a solid proposal by August 7, and then three month of intensive negotiation will follow. At the en of this, the industry will deliver its best and final offer, and the commission plan to award the contract by February 2024.

- 3rd phase is the execution of that contract

She acknowledged the schedule as very challenging, and as probably ruining this year’s vacation plan of many in the European space sector. She also made clarifications regarding the funding: Over the next 7 years, the EU commission has provisioned 2.4 billion euros. 600 million euros can be added by ESA, on the basis of the optional program, in which member states can put money if their industry gets a share of the work (but neither they or ESA will have a say on the makeup of the consortium). That gives a total of 3 billions. However, over the next 12 years, the commission can procure 6 billion euro for IRIS², the difference between that and the 3 billions above coming from a mix private operators in a PPP format, and further EU funding in years 7-12. The objective for her is that she gets the sovereign communication segment the EU and its member states need, and through the PPP commercial partners can pursue their own interest as long as share the financial burden. For the commission, IRIS² is not about the money, it is about the EU’s strategic interests.

The moderator pushed to understand what she thought of having to negotiate with only one bidder, that bidder being a giant (he previously used the term “like the Empire from Star Wars”, other more critical observers might describe it as a monopoly) with all the big European primes and satcom operators. He did not get much of answer, but she underlined that is is a commission requirement that at least 30% of the funding (presumably of the 6 billion total) go to SMEs.

Tensions with SMEs

Mr de Selding then turned to Mr Galic, asking why Unseenlabs was part of the initial architecture studies but not of the final consortium. Mr Galic answered that he did not know, and that he is waiting for requirements (presumably on how to integrate his business to IRIS²). He also acknowledged that even though there is no bid from a consortium of SMEs, such a consortium is being built discreetly and will include companies with expertise in the ground segment, such as the user terminals.

Interestingly, a similar view was echoed later in the day in the New Space panel by Exotrail CEO David Henri, who made an offhand remark that his products were “more likely to be on a US Space Force satellite than on IRIS²”, and when asked to expand on that in a follow up question explained his grievances. As a supplier in the space industry, he is actually not too worried as he thinks if his products are competitive, he can get some IRIS² business, although he got rejected by the commission when applying to be an official supplier as he is not part of the main consortium. However, as a taxpayer, he is concerned there is not a level playing field at the European level between startups and established players. His co-panelist Josef Fleischmann, COO of ISAR aerospace, a startup developing a small launcher, concurred and stressed that he is competing for a small portion of the IRIS² innovation funds, a 40 million euro fund, contrasting it with the 6 billions for the overall program.

Conclusion

In my opinion, IRIS² is living in “interesting times”. The commission probably hoped to spur competition among the big EU space players, and to receive several offers to have more negotiation margin. However, as these players formed a single consortium – a quasi monopoly, which the commission probably would have squashed on the basis of excessive market power if IRIS² did not have the political exposition and importance it has – the commission will be in a very difficult position. It could have chosen to end the program there and restart it in a different form but that would incur delay and make it lose face. Instead, it will now have to go along with it, and use the 30% of funds that is bound for SMEs as leverage, but that leverage will be less that if these SMEs were competing as primes.

Another topic that is very unclear for now is how IRIS² could integrate other services beyond communications. The CTO of Hispasat mentioned hosted payloads, and inter satellite links with an observation constellation to act as backhaul are also a possibility, but judging by the answer from the president of Unseenlab, there is no clear specification for either of those.

Compare this to the strategy of the US space development agency, which to built its Proliferated Warfighter Space Architecture -a constellation providing communication, observation and missile tracking services- is competing it in several tranches with several manufacturers being awarded part of each tranche, and with a clear optical inter satellite link standard so that the satellites of these manufacturers can talk to each other:

IRIS² seems to be the only shot Europe has at building a sovereign and secure constellation, and a proliferated observation constellation has as much military importance as a communications one. With the large number of both established players and startups in the European Earth Observation sector, it would be a grave misstep not to be able to seamlessly integrate them in the commission’s project. One can hope that there will be soon a convergence between IRIS² one one hand and Copernicus with its Newspace contributing missions on the other hand.

[…] four years of absence due to COVID, and was preceded by the Paris Air Forum, a day of talks and roundtables by aerospace executives. A few days later, the second edition of the French New Space conference […]

LikeLike